By Tiana Lowe Doescher

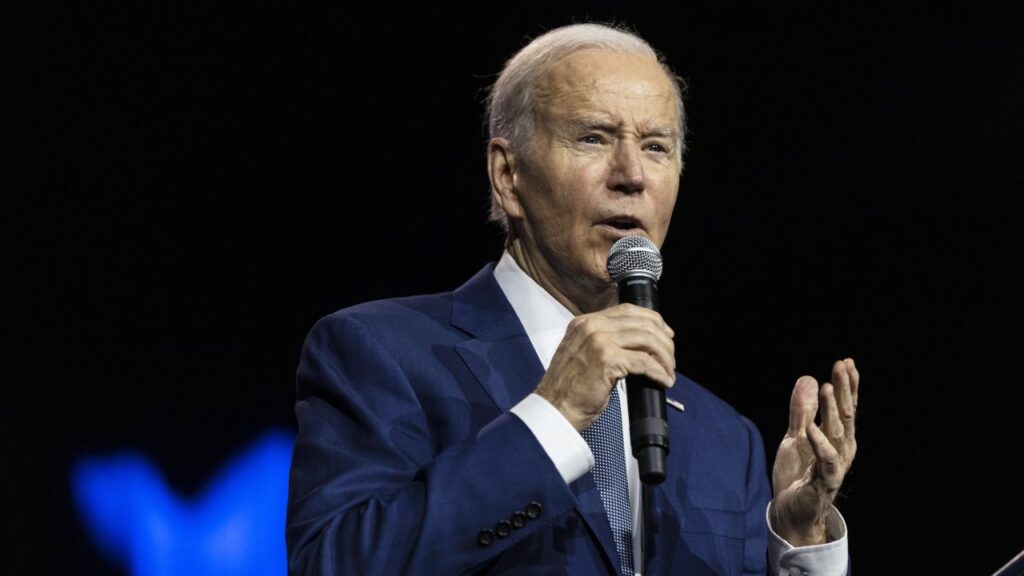

Starting next month, President Joe Biden will borrow from the middle class to pay for homeownership for the financially unreliable. In the name of “equity,” the majority of the mortgage market regulated by the Federal Housing Finance Agency will make prospective buyers with good-to-great credit scores pay more to fund reduced interest rates for those with bad credit scores.

You might recall that federal regulators tried pursuing the white whale of universal homeownership in the years leading up to 2007. The result? A bunch of people with bad credit scores — that is, a history of being unable to pay back their debt in a timely manner — were unable to pay back their mortgages on their McMansions in a timely manner. Because those obviously subprime mortgages were bundled up and billed as triple-A investments, investors were dumbstruck when the value of these mortgage-backed securities plummeted.